Our Strategy

With Montego Minerals, our investors are accessing some of the most diversified and strategically

packaged mineral portfolios in the industry and it all begins with our disciplined acquisition strategy.

Over the last 5 years, our engineering team has sourced, evaluated, and engineered more than $500 million in high grade mineral real estate. Our evaluation metrics maintain a strict "fly or don't fly" model. This underwrites our ability to purchase the strongest, most suitable properties for our family of investors.

Below are a few criteria we examine in effort to determine property value:

- Current income from existing production

- Number of producing wells

- Number of zones (benches) remaining to be developed

- Total future revenues that result from full development

- Number of active permits for new wells likely to be drilled in the near term

- New wells drilled on off-set tracts and the performance of that drilling

During this evaluation process, our team uses commercial and proprietary databases with large volumes of geologic and engineering records. This data is evaluated using spreadsheet calculations and engineering & economic software. Over the past six decades, Montego Minerals has developed and evaluated thousands of production curves and well logs for most all producing oil and gas regions throughout the United States.

Evaluating an intangible asset class such as minerals and royalties, takes true technical skill and Montego Minerals and our team of qualified engineers have developed established buying criteria to mitigate traditional risks commonly associated with oil and gas investing.

ACTIVE MANAGEMENT PRACTICES

ANNUAL ENGINEERING AND ECONOMIC ASSET REVIEWS

MONTHLY DISTRIBUTIONS

INTERNAL COST DEPLETION TAX PREPARATION

STRATEGIC PROPERTY SALES POTENTIAL

EXTENSIVE ENERGY INDUSTRY RELATIONSHIPS

Royalties and minerals can have substantial tax-advantages to investors using Cost Depletion. Cost depletion is a calculation of your cost basis against the depleting reserves on a given oil and gas property. This tax advantage can be substantial in the first 5-7 years of investment ownership. Depending on varying client investment basis, it is likely, via cost depletion, for clients to protect 50-100% of their annual royalty cash flow from federal taxes. Below is an example of a three year scenario using Cost Depletion, assuming a complete basis in year one.

MINERALS ARE “LIKE-KIND" TO TRADITIONAL REAL-ESTATE AND ARE 1031 EXCHANGE ELIGIBLE

Royalties are afforded and awarded multiple tax advantages. Besides the more obvious 1031 exchange solutions, royalties have both a “Percentage Depletion Allowance” and a “Cost Depletion Allowance”. With Percentage Depletion, each investor, regardless of basis, can shelter 15% of the royalty revenue they generated on an annual basis, in perpetuity. That's correct, forever. With Cost Depletion the math is a bit more complicated. Cost depletion is a tax shelter on the royalty revenue allowing investors to protect a significant portion of their income over the first 5-7 years of asset ownership. This tax advantage is calculated through the depleting reserve basis on current production. The depletion calculation is then multiplied by a client’s current cost basis. Each year, client basis’ is re-adjusted down, allowing less and less of a shelter over time. However, throughout the first 5-7 years of ownership, Cost Depletion allowance can protect 50-100% of royalty cash flow on an annual basis.

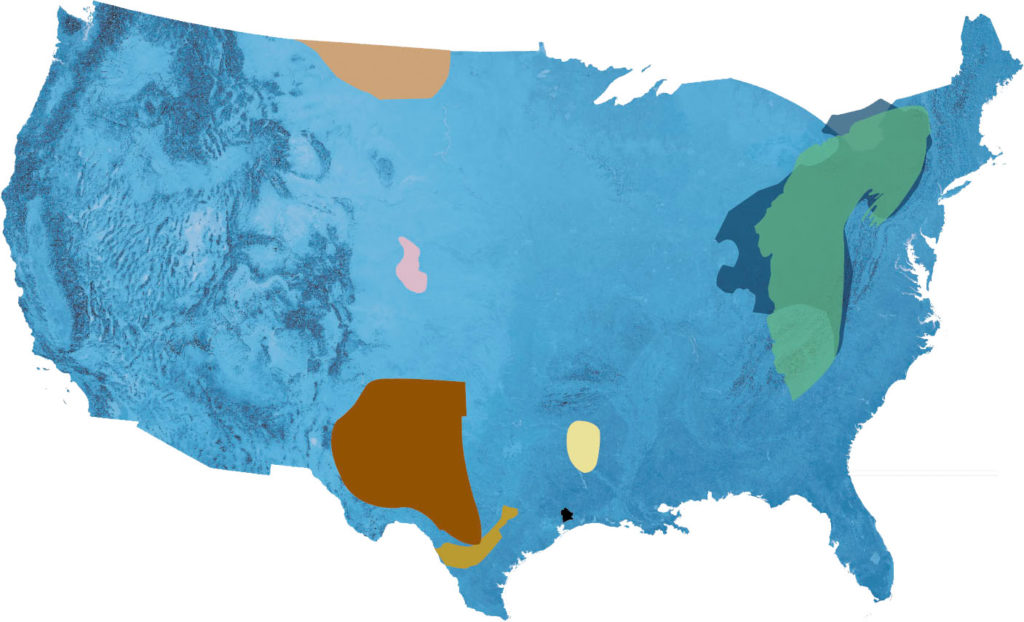

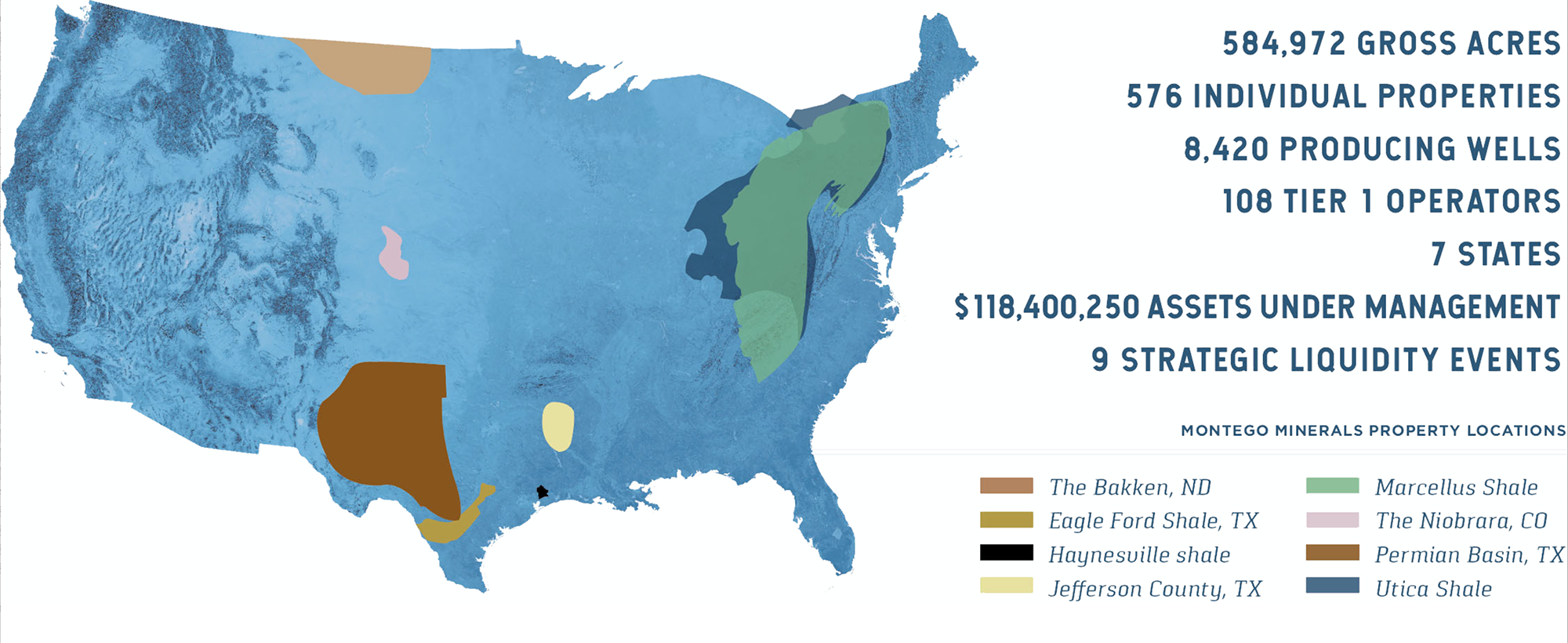

Our Portfolio Footprint

584,972 Gross Acres

576 Individual Properties

8, 420 Producing Wells

108 Tier 1 Operators

7 States

$118, 400,250 Assets Under Management

9 Strategic Liquidity Events